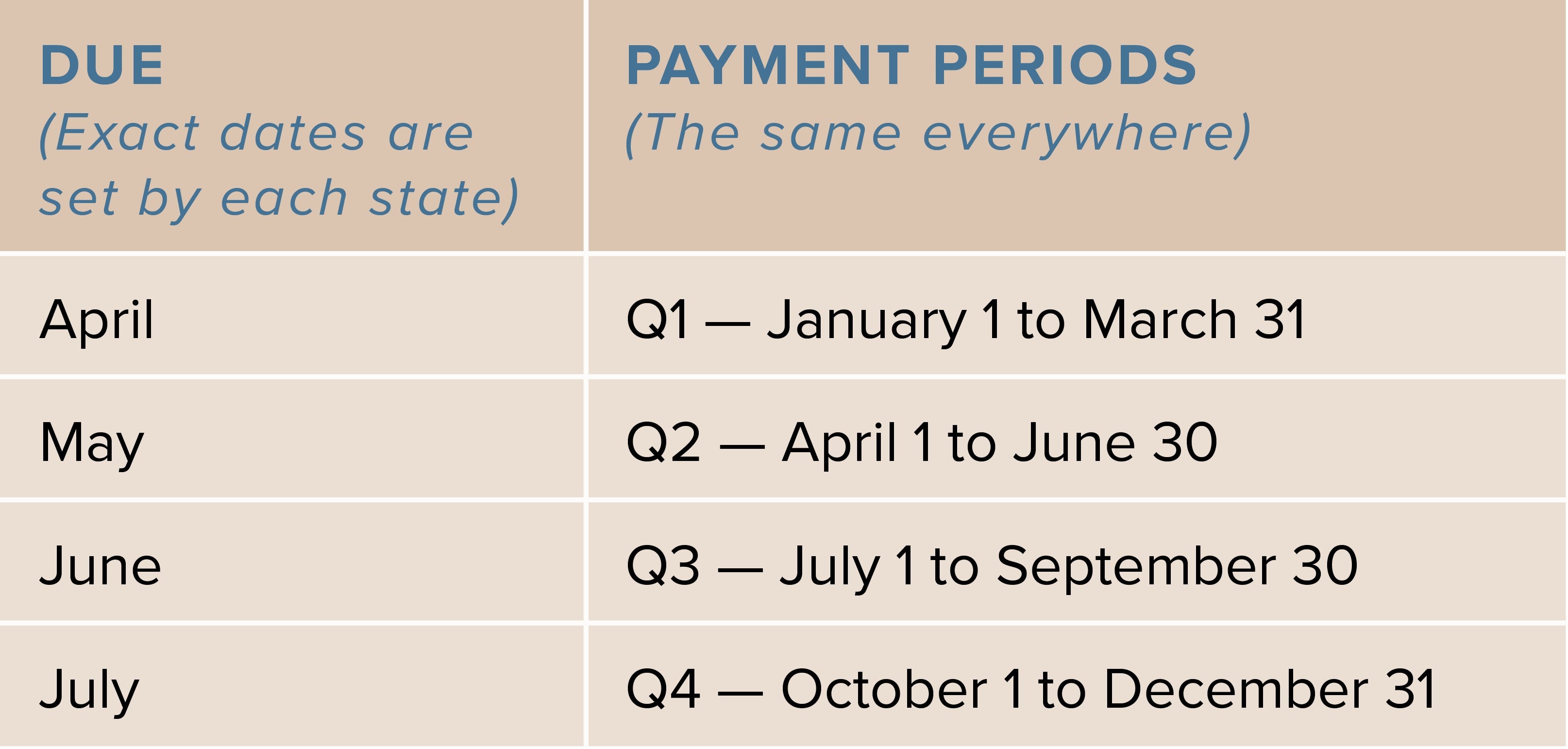

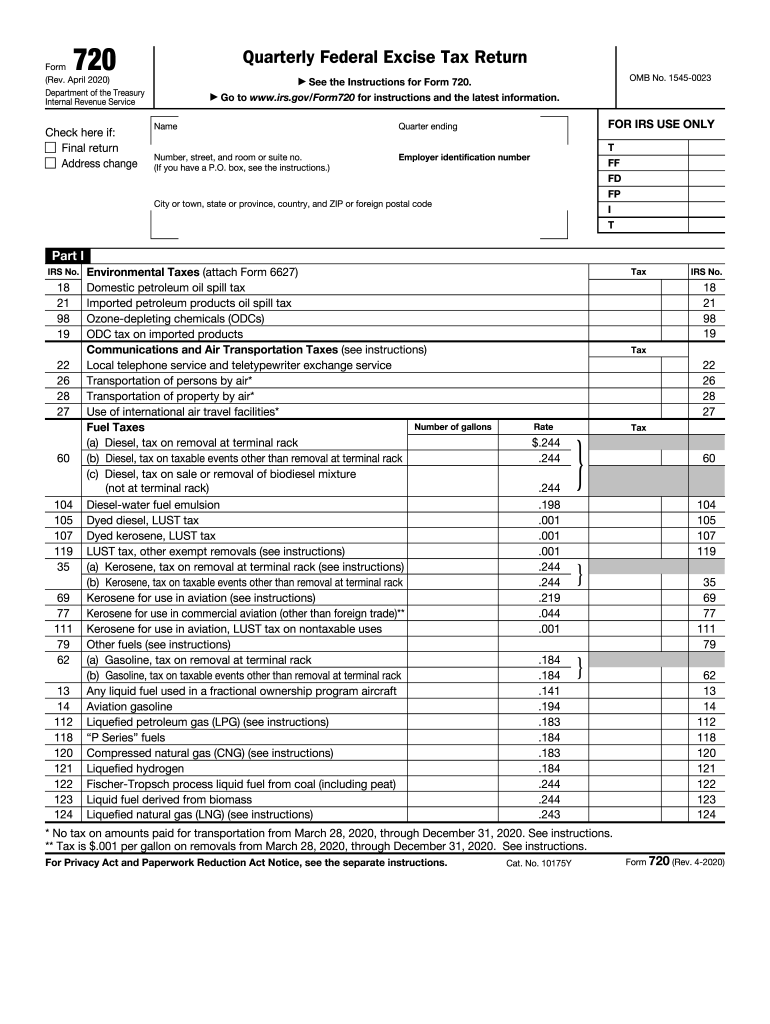

Irs Quarterly Estimated Tax Payments 2025. Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. The irs noted, however, that payments on these returns are not eligible for the extra time because they were due last spring before the hurricane occurred.

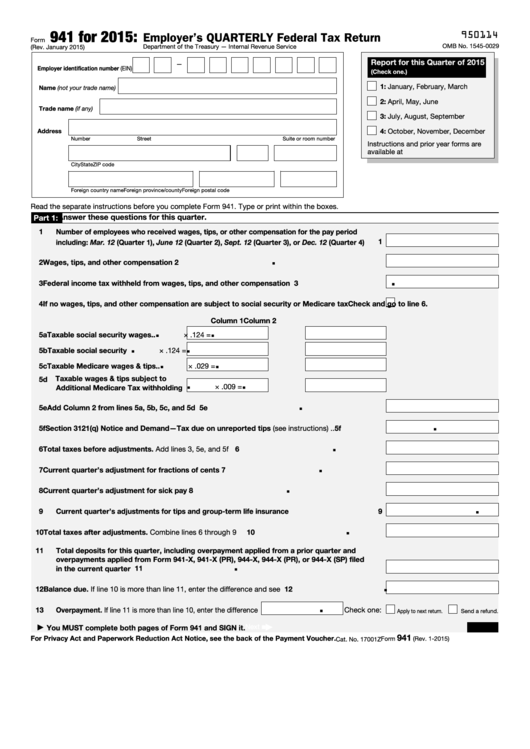

Who has to make quarterly estimated tax payments? 15, 2025 — the internal revenue service today reminded taxpayers who didn’t pay enough tax in 2025 to make a fourth quarter tax payment on or before.

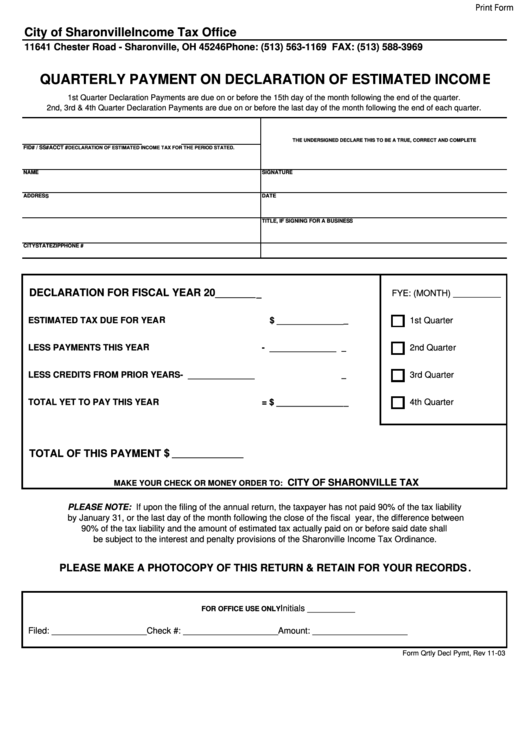

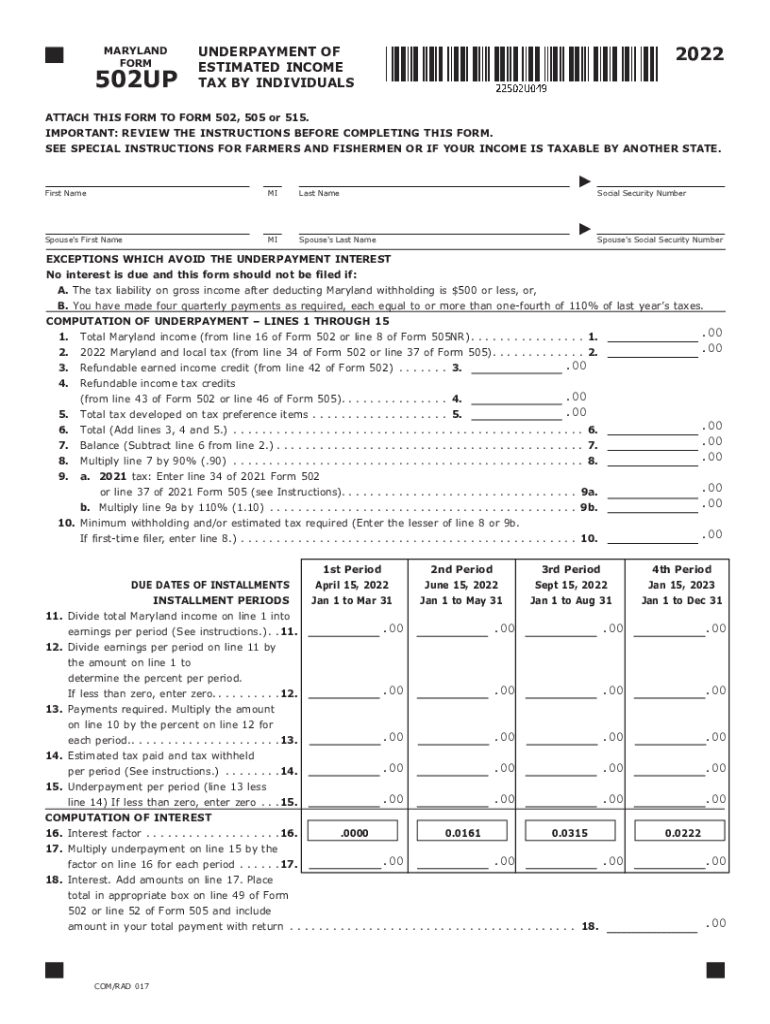

Quarterly Tax Payment Schedule 2025 Edie Nettie, This estimated tax payment's late penalty is calculated based on the amount owed and.

Irs 2025 Quarterly Estimated Tax Forms Cherry, Making quarterly payments on time has more benefits than maintaining compliance with the irs.

Quarterly Payments Irs 2025 Eva Shawnee, How to make estimated tax payments and due dates in 2025.

Irs Estimated Tax Payments 2025 Dotti Gianina, Learn about quarterly estimated tax payments for individual income tax, including due dates and how to pay estimated taxes on your taxable income.

Estimated Tax Due Dates 2025 Irs Alexa Marlane, The irs noted, however, that payments on these returns are not eligible for the extra time because they were due last spring before the hurricane occurred.

2025 Irs Form 941 Milli Suzanne, 15, 2025 — the internal revenue service today reminded taxpayers who didn’t pay enough tax in 2025 to make a fourth quarter tax payment on or before.

2025 Estimated Tax Payment Schedule Eden Yevette, That means many are gearing up to file their taxes with the.

Estimated Quarterly Tax Payment Dates 2025 Form Ailee Meredithe, These include changes in tax rates, deductions, and credits.

What To Do If You Miss a Quarterly Tax Payment, Taxpayers who file a kentucky tax return and expect to owe more than $500 (after any taxes withheld and allowable credits) must make estimated tax payments.