Lifetime Tax Exemption 2025. Lifetime gift and estate tax exclusions. The irs has increased the estate, lifetime gift,.

This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on it. The federal estate tax and gst tax lifetime exemption amounts have increased by $690,000 for individuals in 2025 (to $13.61 million from $12.92 million in.

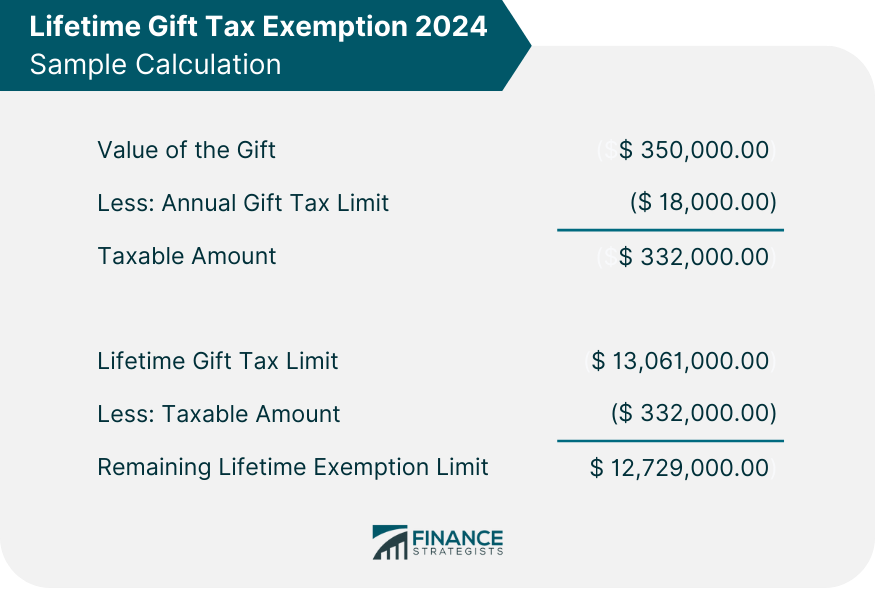

Annual Gift Tax Exemption 2025 Marin Sephira, In 2025, the lifetime gift tax exemption is $13.61 million per individual. If a gift exceeds the $18,000 limit for 2025, that does not automatically trigger the gift tax.

Lifetime Gifting Exemption (IHT) TT Wealth Estate Planning, The lifetime estate and gift tax exemption for 2025 deaths is $12,920,000. Importantly, even though the irs has announced an increase in the lifetime gift and estate tax exemption to $13.61 million in 2025, that amount is scheduled to be.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, How are gift and estate taxes figured? The irs has increased the estate, lifetime gift,.

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, Both are indexed to increase with inflation, and both jumped in 2025. If you're married, your spouse is entitled to a separate $12.92 million exemption and can inherit your unused lifetime.

Preparing for the Estate and Gift Lifetime Tax Exemption Sunset (2025), Under this, the basic exemption limit was hiked to rs 3 lakh from rs 2.5 lakh, while the rebate under section 87a of the income tax act, 1961, was increased from rs. The irs has increased the estate, lifetime gift,.

Exemptions From Minimum Wage & Overtime Rules, Can my spouse use my lifetime exemption? The annual exclusion amounts are adjusted for inflation each year.

Gift Tax Limit 2025 Explanation, Exemptions, Calculation, How to Avoid It, Citizens and those domiciled in the united states have increased to $13,610,000 per taxpayer, an. The federal estate tax and gst tax lifetime exemption amounts have increased by $690,000 for individuals in 2025 (to $13.61 million from $12.92 million in.

Lifetime Gift Tax Exemption 2025 All you need to know about it is here, The lifetime gift tax exemption is a federal tax law that allows an individual to give gifts of up to a certain amount without incurring gift taxes. This means that each person can give away this amount during their lifetime without having to.

Gift Tax 2025 What It Is, Annual Limit, Lifetime Exemption, & Gift, The lifetime exemption from the federal gift and estate tax will rise to $13.61 million per person (from $12.92 million per person in 2025). It is important to know the correct income tax rules for every.

Annual Gifting Limits 2025 Lynn Sondra, The total limit for lcge (lifetime capital gains exemption) is adjusted every year to keep up with inflation. Starting april 1, 2025, qualifying individuals buying homes up to $835,000 now receive an exemption on the property transfer tax on the first $500,000 of the home’s.

Starting january 1, 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.