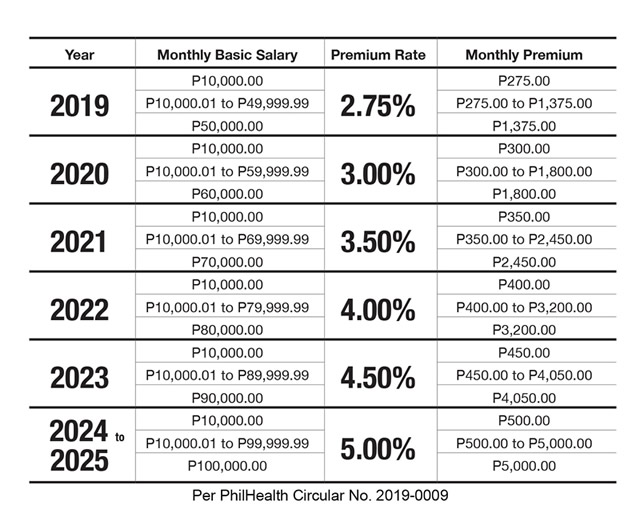

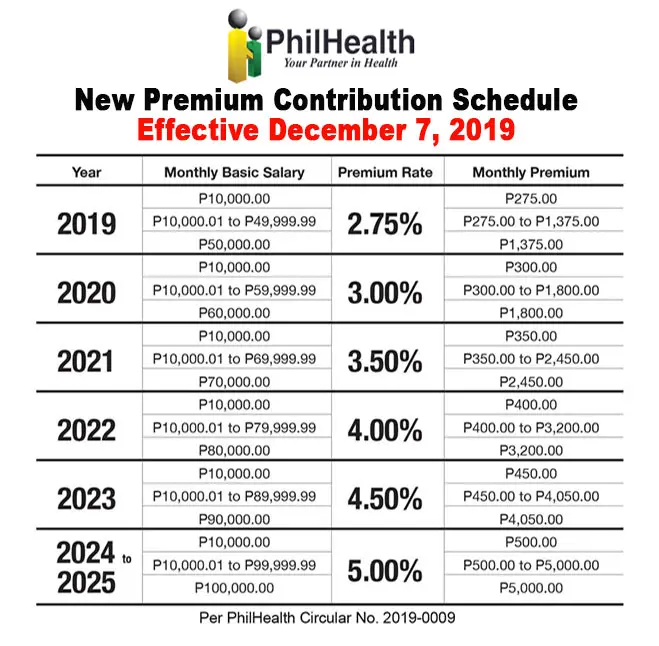

Philhealth Monthly Contribution 2025. For the philhealth contribution rate 2025, it is eyed at 5.00%. 5% so, if you're earning ₱50,000 a month, your philhealth contribution would be.

All premiums are expected to follow the 5% premium rate for. Here is a guide on the premiums based on the monthly income of the member:

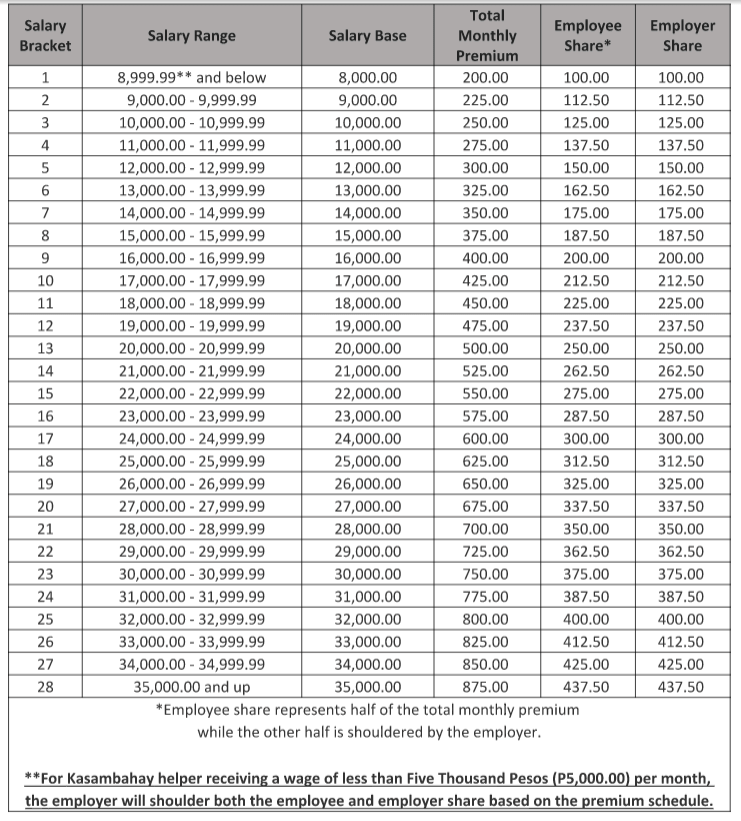

PhilHealth Contribution Table for Employees and Employers, The new philhealth contribution table 2025 is set to follow the universal health care law (republic act 11223). Ready to adult like a pro?

How to Compute Monthly PhilHealth Payment [Guide] eezi, The philippine health insurance corporation (phic) would like to remind all members that starting january 1, 2025, the monthly premium will increase from 4% to. Philhealth introduced the updated payroll contribution rates in the philippines for 2025 in the latest version of their contribution table released on january 1, 2025.

![How to Compute Monthly PhilHealth Payment [Guide] eezi](https://www.eezi.com/wp-content/uploads/2023/01/PhilHealth-contribution-sample-1024x683.png)

Philhealth Monthly Contribution Computation 2025 KG Consult Group Inc., We are using the latest philheath contribution table 2025 to derive the right result for you. The table below outlines the revised contribution.

New PhilHealth Contribution Table, For employed individuals, the philhealth contribution rate is calculated based on monthly salary brackets. We are using the latest philheath contribution table 2025 to derive the right result for you.

Philhealth Contribution Table from 2019 to 2025 Life Guide PH, The contribution is still set at 3% following the announcement made by philhealth. What if i miss a contribution payment?

New PhilHealth Contribution Table, For the philhealth contribution rate 2025, it is eyed at 5.00%. Those making p10,000.01 to p99,999.99 a month will have p500 to p5,000 deductions from the state insurer.

BIR Tax Information, Business Solutions and Professional System, Here’s how you can do it: The employee contribution rate to philhealth is set at a steady 4%.

Philhealth Contribution Table 2020employed, selfearning & OFW NewstoGov, For employed individuals, the philhealth contribution rate is calculated based on monthly salary brackets. Latest philhealth contribution table 2025.

New Philhealth Contribution Table 2019 2025 2025 2025 2025 2025 2025 PDF, All premiums are expected to follow the 5% premium rate for 2025. For employed individuals, the philhealth contribution rate is calculated based on monthly salary brackets.

Philhealth Contribution 2025 Understanding Eligibility, Exploring, The employee contribution rate to philhealth is set at a steady 4%. January 11, 2025 by fehl dungo.